maine tax rates by town

The statewide median rate is 1430 for every 1000 of assessed value. Auburn ME Sales Tax Rate.

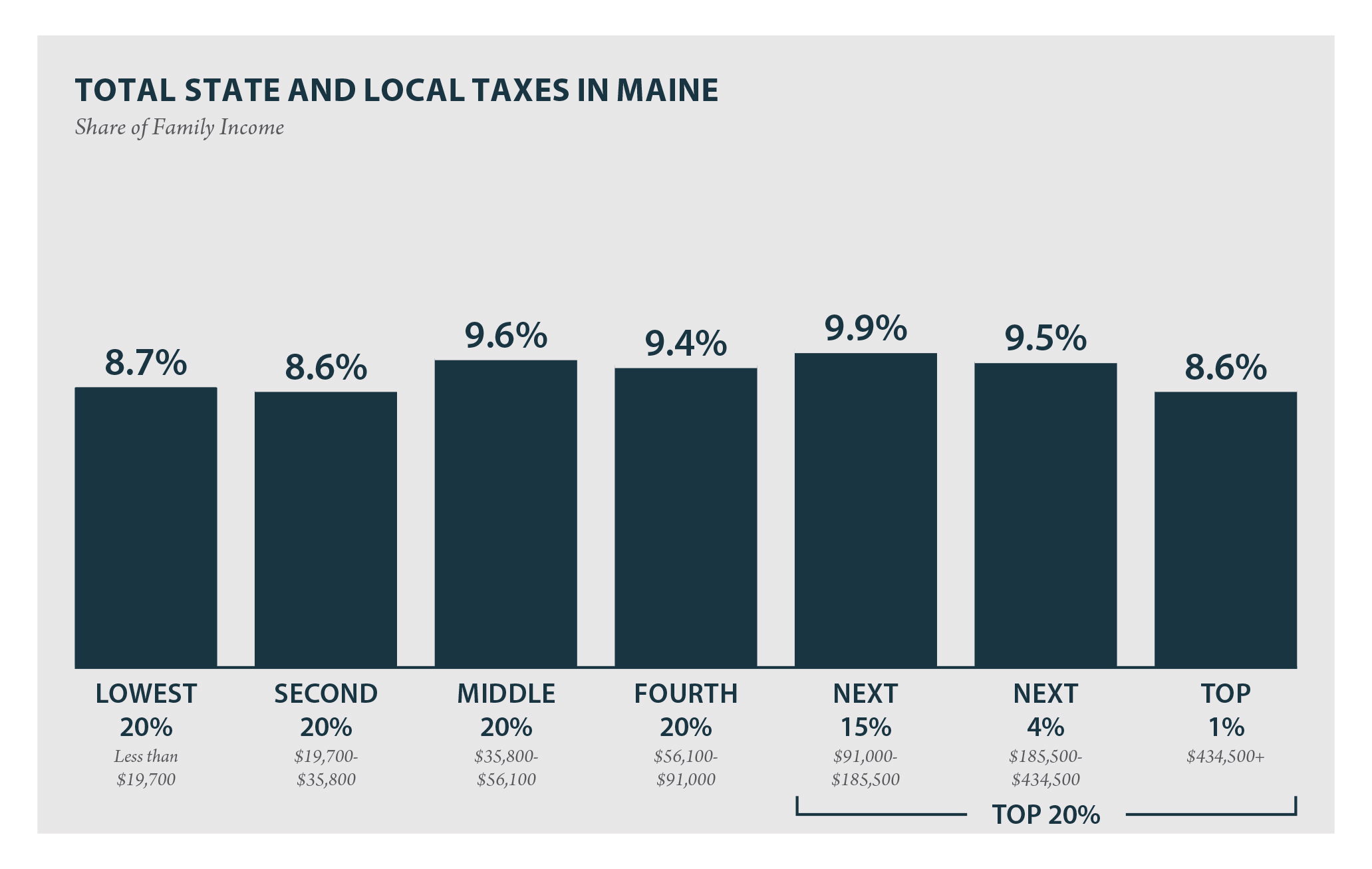

Maine Who Pays 6th Edition Itep

Maine has a graduated individual income tax with rates ranging from 580 percent to 715 percent.

. This unit is responsible for providing technical support to municipal assessors taxpayers legislators. The total assessed valuation of exempt property is currently 249707600. The median property tax in Maine is 109 of a propertys assesed fair market value as property tax per year.

Maine also has a corporate income tax that ranges from 350 percent to 893 percent. Cities in that county include. This map shows effective 2013 property tax rates for 488 Maine cities and towns.

Tax Rates LD 290 - Stabilization of Property Taxes - Application and. 2022 Taxes were committed on September 17th with payment due on November. E-911 Street Name and Addressing.

The minimum combined 2022 sales tax rate for Old Town Maine is. Real Estate Tax Bills Download a copy of your tax bill by clicking the link. The Property Tax Division is divided into two units.

Real Estate Tax Bills Download a copy of your tax bill by clicking the link. Please contact the Tax Collector if you would like to receive your tax bills electronically. Our division is responsible for the determination of the annual equalized full value.

Property tax rates in the county are reasonably close to the state average as the average effective rate. Please contact the Tax Collector if you would like to receive your tax bills electronically. Towns with rates above the.

State of Maine Online Septic Plan Search. Payment of these taxes can be made right now. The Town of Palermo operates on a calendar year from January to December.

There is no applicable. Full Value Tax Rates Represent Tax per 1000 of Value EAGLE LAKE 1445 1575 1679 1650 1564 1618 1565 1458 1455 1466 EASTON 1595 1685 1754 1726 1737 1739 1521. City Total Sales Tax Rate.

Tax amount varies by county. Lawrence County New York United States. 27 rows Maine Relocation Services Local Tax Rates.

13 rows The following is a list of individual tax rates applied to property located in the. The minimum combined 2022 sales tax rate for Old Town. Finally the third most expensive area for Maine property taxes is Penobscot County with a rate of 145 percent.

The Municipal Services Unit is one of two areas that make up the Property Tax Division. Municipal Services and the Unorganized Territory. The Property Tax Division prepares a statistical summary of selected municipal information that must be annually reported to MRS by municipal assessing officials.

How high is your towns property tax rate. A wealth of information. The population was 11194 at the 2010 census.

2022 List of Maine Local Sales Tax Rates. Maine is ranked number twenty out of the fifty. Local government in Maine is primarily.

Ogdenburg is a city located in St. Lowest sales tax 55 Highest sales tax 55. Penobscot County is in central Maine and contains the states third-largest city Bangor.

Augusta ME Sales Tax. At the median rate the tax bill on a property assessed at 100000 would be 1430.

Maine Property Tax Rates By Town The Master List

Opinion Property Tax Stabilization Program Shifts Burden To State Taxpayers The Maine Wire

How Do State And Local Property Taxes Work Tax Policy Center

Sales Taxes In The United States Wikipedia

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Local Maine Property Tax Rates Maine Relocation Services

Current Tax Rate Town Of Buxton Me

Maine Reaches Tax Fairness Milestone Itep

New Maine Law Allowing Seniors To Freeze Property Taxes Takes Effect Maine Public

Maine Treasurer Announces Restrictions For Delinquent Property Tax Rates Maine Thecentersquare Com

Maine S Tax Burden Is One Of The Highest New Study Says Mainebiz Biz

Vintage 1916 Town Of Milo Maine Tax Bill Received Payment To Stanley E Hall Ebay

Maine Property Tax Calculator Smartasset

Maine Who Pays 6th Edition Itep

In This State Seniors Can Now Freeze Their Property Taxes Here S How Marketwatch